3 New Mortgage Rule Changes Starting From January 2018

- by realtorvinod

Qualifying rate stretch test to every single uninsured home loan

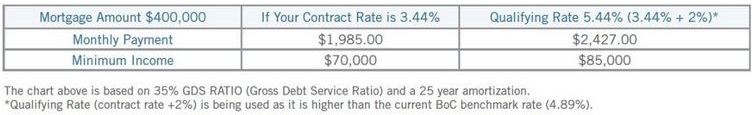

Uninsured home loan purchasers should now qualify utilizing another base qualifying rate. The rate will be the more prominent of the five-year benchmark rate distributed by the Bank of Canada OR the moneylender authoritative home loan rate +2.0%.

How does this influence the home loan buyer with an up front installment/equityof at least 20%?

The greatest effect will be on the sum for which the home purchaser/proprietor will have the capacity to qualify. Already, the home purchaser/proprietor qualified at the agreement rate offered by the loan specialist. While the real home loan installment will even now be paid at the agreement rate, a higher computation will be utilized for capability purposes.

For instance:

Do despite everything I have the alternative to renegotiate my home?

Indeed, mortgage holders will in any case can renegotiate up to 80% of the estimation of their property. You should breeze through a similar anxiety test which is the higher of the BoC five-year benchmark rate (right now 4.89%) OR the agreement rate from the bank in addition to 2%.

Moneylenders will be required to improve their credit to-esteem (LTV) estimation and points of confinement to guarantee chance responsiveness

Home loan banks (barring credit unions and private moneylenders) must build up and cling to suitable LTV proportion restricts that are intelligent of hazard and refreshed as lodging markets and the financial condition advance. We are anticipating more points of interest on this approach from loan specialists. As we have new data, we will refresh this archive.

What does this mean?

OSFI coordinates loan specialists (barring credit unions and private moneylenders) to have interior hazard administration conventions in higher estimated markets (now and then called “hot land markets†like Toronto and Vancouver). This is a continuation of an arrangement as of now set up. Many home loan banks have been following the standards of the strategy for the last 10 to a year.

Limitations will be set on certain loaning game plans that are composed, or seem intended to maintain a strategic distance from LTV limits

Home loan moneylenders (barring credit unions and private banks) are precluded from masterminding with another loan specialist: a home loan, or a mix of a home loan and other loaning items, in any frame that dodges the institution’s most extreme LTV proportion or different points of confinement in its private home loan guaranteeing strategy, or any prerequisites set up by law. This is regularly alluded to as “bundling†or “bundle partnershipâ€.

What does this mean?

For instance: a buyer applies for a home loan with a 80% LTV and the bank can just favor 65%. The loan specialist at that point accomplices with a moment moneylender for the extra 15%. The first bank then “bundles†the 15% LTV contract with the first 65% home loan to frame the entire 80% LTV credit. This is never again allowed according to OSFI.

Qualifying rate stretch test to every single uninsured home loan Uninsured home loan purchasers should now qualify utilizing another base qualifying rate. The rate will be the more prominent of the five-year benchmark rate distributed by the Bank of Canada OR the moneylender authoritative home loan rate +2.0%. How does this influence the home loan…